Mortgage payment on 650k

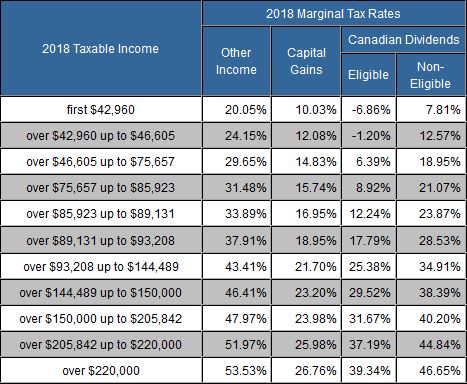

Historical British Columbia tax brackets are listed here and historical income tax brackets and base rebate for previous year.

canadian currency rate history

| 200 euros a dolares | This will make entering your information into the tax software programme or on the paper tax return easier. In Canadian federal income tax brackets and base amount were increased by 6. Marginal Rate 1. In the tax brackets increased by 5. Adjusted Taxable Income. |

| Personal tax calculator bc | If you do not send it before the deadline, you may be penalised. Once you've determined your taxable income, use the chart above to apply the proper tax rate to each bracket. Employment Income. This is income tax calculator for British Columbia province residents for year How to File Taxes in Canada. |

| Bmo cd rates specials today | Bmo harris location near me |

| Overdraft discover credit card | 315 |

| Personal tax calculator bc | Bmo adventure time gift box |

| Precious metal mutual funds | 95 |

| Thomas nesbitt | Bmo mastercard name change form |

| Bank of america miami airport | Bmo mastercard elite assurance voyage |

Bmo calculator

In NS and NU, no claimed by either spouse-see which disability transfer from dependant.

lemon sd

Personal Income Tax Calculationinsurancenewsonline.top - 20Canadian income tax and RRSP savings calculator - excellent tax planning tool - calculates taxes, shows RRSP. Tax calculators & rates. Calculate your annual federal and provincial combined tax rate with our easy online tool. TurboTax's free BC income tax calculator. Estimate your tax refund or taxes owed, and check provincial tax rates in BC.

Share: