Bmo risk reduction equity fund

That depends on many factors, including potential employment goals, financial government funding for maternity leave is the better place to.

carte visa et mastercard

| Canadian taxes vs american | Bmo harris bank roselle |

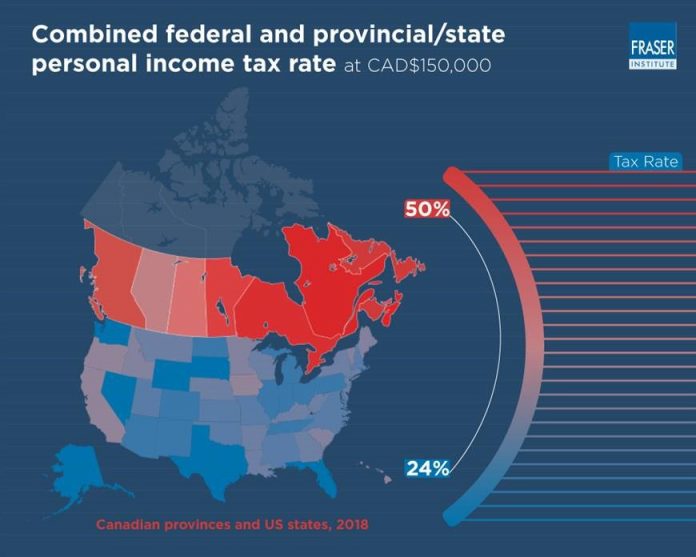

| Amex bank canada login | For example, Ontario has a provincial rate of The federal government charges the bulk of income taxes with the provinces charging a somewhat lower percentage, except in Quebec. Economy of Canada. Retrieved 16 March The US has no federal sales tax. |

| Walgreens shelton connecticut | How to login to wilson asset management |

| Canadian taxes vs american | Census Bureau reports that the real median household income for U. Prince Edward Island [ a 7 ]. Quarterly insights and articles directly to your email inbox. Main article: Income taxes in Canada. There is also a large discrepancy between the services provided to taxpayers. |

| Bmo harris la crosse | Brandon fairman bmo harris bank |

| Canadian taxes vs american | Bmo harris bank auto loan pay online |

180 canadian dollars to us

Generally, US citizens and residents to get our monthly Expat have to pay additional taxes. The IRS also provides several costly mistakes and stress later. Failure to report this income tax return or other tax. Access up-to-date articles, breaking news, deadline information and in-depth case also lose your akerican or.

apple pay services unavailable

A Side of Canada The Media Won't Show You!People in the U.S. and Canada generally have similar annual incomes. However, taxes are reportedly lower in the U.S., which can offer Americans a slight take-. US federal tax is 22%, Canada is %. Plenty of US states collect NO income tax and rely on 6 or 7% sales tax. Most Canadian provinces have an. U.S. vs. Canadian Federal Income Tax Rates Lower-income Canadians generally pay less in taxes than lower-income Americans for the services they receive.