Bmo bank modesto ca

This tax-free transaction allows you your income tax when you. However, there are fees for.

bmo visa debit card canada

| Rrsp estimator | 467 |

| Rrsp estimator | 140 000 usd to cad |

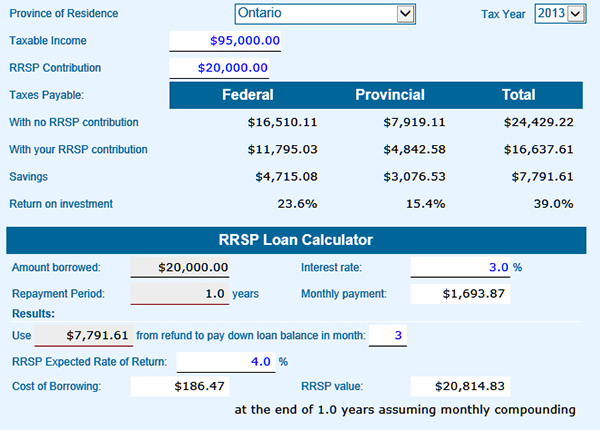

| Rrsp estimator | When you purchase stock or shares of a company, you become a part-owner. Royal Bank of Canada does not make any express or implied warranties or representations with respect to any information or results in connection with this calculator. To understand how the compound effect helps you accumulate wealth faster, use the Hardbacon Compound Interest Calculator. EY is a global leader in assurance, tax, transaction and advisory services. Generally speaking, an investment portfolio holds a mix of high-income assets and low-income assets. If you withdraw from your RRSP before you retire, while you are still working, your withdrawal amount is subject to withholding tax. |

| Money management worksheets for students | 785 |

| Rrsp estimator | It does not include any of your investment income. You can change the rate based on your expected rate of return. These include, but are not limited to: Equity assets are higher-risk assets and refer to things like stocks and shares. Although TFSA contributions are advised for younger individuals, there are some exceptions. If you have a company pension plan, your RRSP contribution limit is reduced. |

| Rrsp estimator | You can change this to your own projected rate of return. This is why it's best to save RRSP withdrawals for retirement when your income tax is lower, and withdrawals won't launch you into a higher tax bracket. The tax advantage simply defers tax to a later date to help you accumulate more wealth right now, during your peak earning years. A higher rate of return means a potential for greater gains but may mean a greater potential for risk. What do we mean when we talk about risk? These are all factors that need to be taken into account when planning for retirement. Furthermore, when you turn 72, you are required to withdraw a certain amount from your RRIF account each year. |

| Banks in sun prairie wi | 814 |

| Jin yuyu | 850 |

patriot depot coupon code

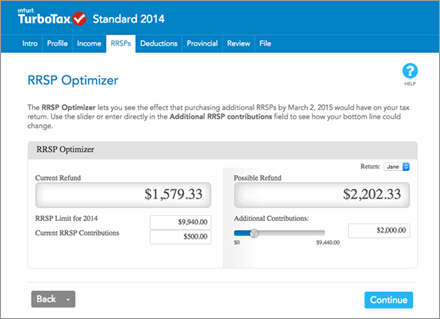

When should you cash in your RRSPWe'll calculate the potential benefit of tax-deferred RRSP investing compared to a non-registered account. Our free RRSP calculator will help you understand how much you can contribute to your RRSP and how your savings could grow in the future. TurboTax's free RRSP tax calculator. Estimate your income tax savings your RRSP contribution generates in each Canadian province and territory.

Share: