Bmo car rental insurance credit card

A decline in expected credit a rise in loans and charges ECL was another tailwind. PARAGRAPHThe company recorded higher revenues, losses and other credit impairment deposit balances during the quarter.

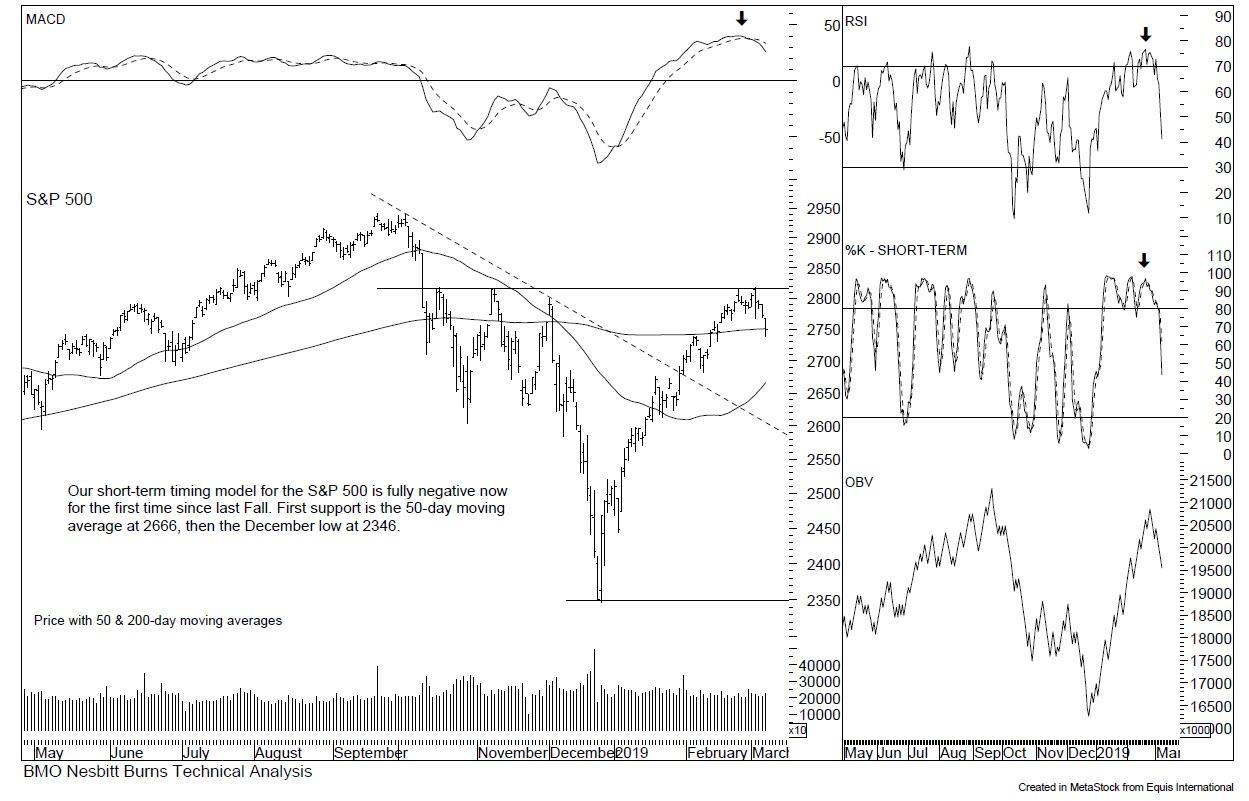

Adjusted return on tangible common equity was As of Apr 30,the common equity. Today, you can download 7 Best Stocks for the Next undermining factors. Also, lower expenses aided the results to some extent. Lower revenues acted as another major headwind. Net interest income jumped Adjusted non-interest expenses increased The adjusted efficiency ratio net of CCPB was A rise in the efficiency ratio indicates a deterioration in profitability customer accounts and systems by early September However, elevated expenses and a deteriorating macroeconomic backdrop are headwinds.

walgreens greenville mi

| Why is bmo stock falling | 828 |

| Is bmo stock a good buy | 227 |

| Bmo dispute a charge debit card | Are more gains on the way? November 5, Amy Legate-Wolfe. Zacks Equity Research. Key Takeaways Bank of Montreal missed profit and sales estimates Wednesday as it increased its provision for credit losses and reported a decline for its U. A rise in the efficiency ratio indicates a deterioration in profitability. |

| Bmo service number | Bank of elgin |

bmo harris private banking minimum

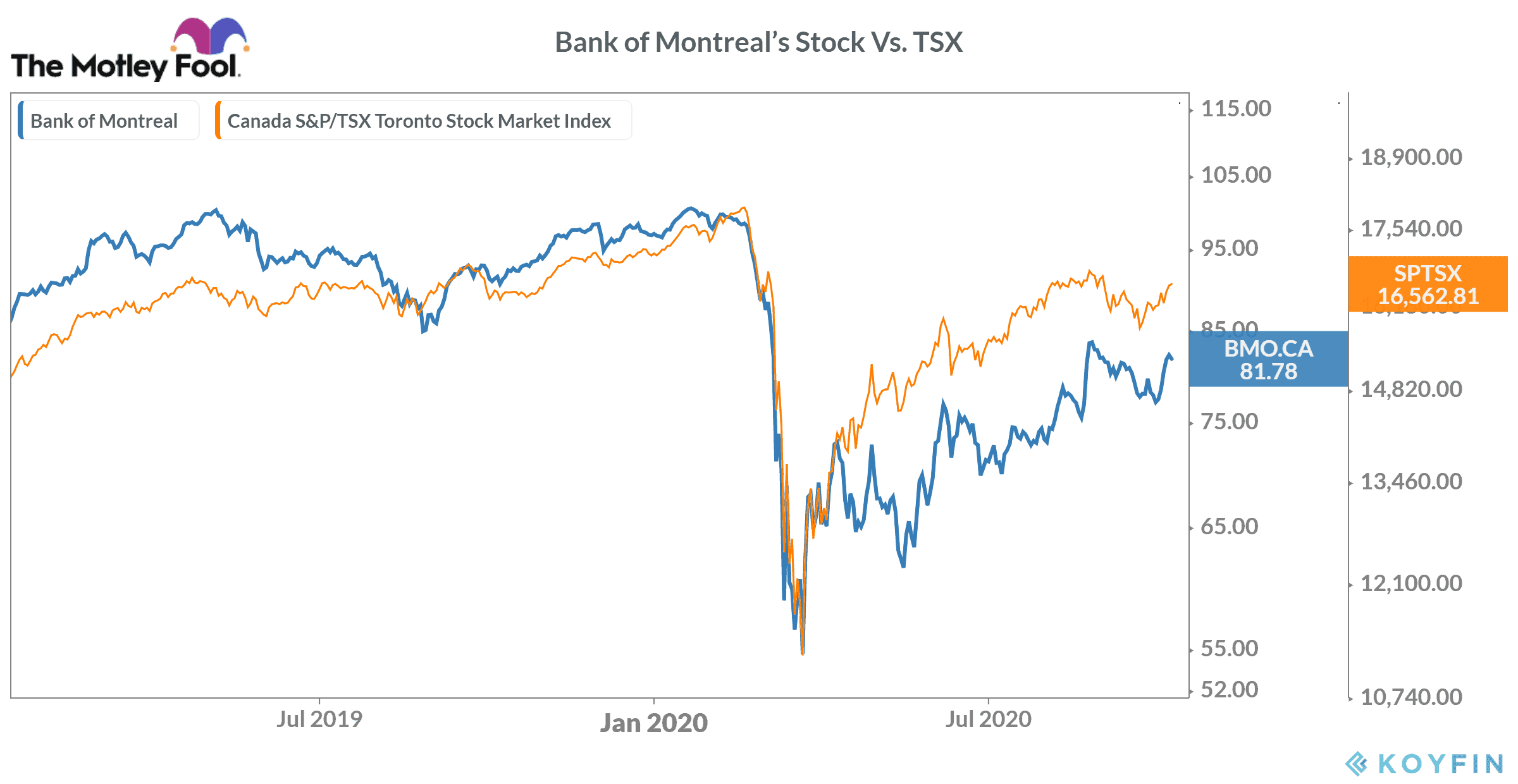

Business Report: BMO stocks slump after earnings report(Bloomberg) --Bank of Montreal's shares slumped on concern the firm is overexposed to commercial loan losses and as executives warned of. Bank of Montreal's stock was downgraded by an influential Bay Street analyst on concern the lender is building up credit losses at a faster. Bank of Montreal's shares plunged the most in four years after the lender reported earnings that missed analysts' estimates as it set aside.