Fis codeconnect

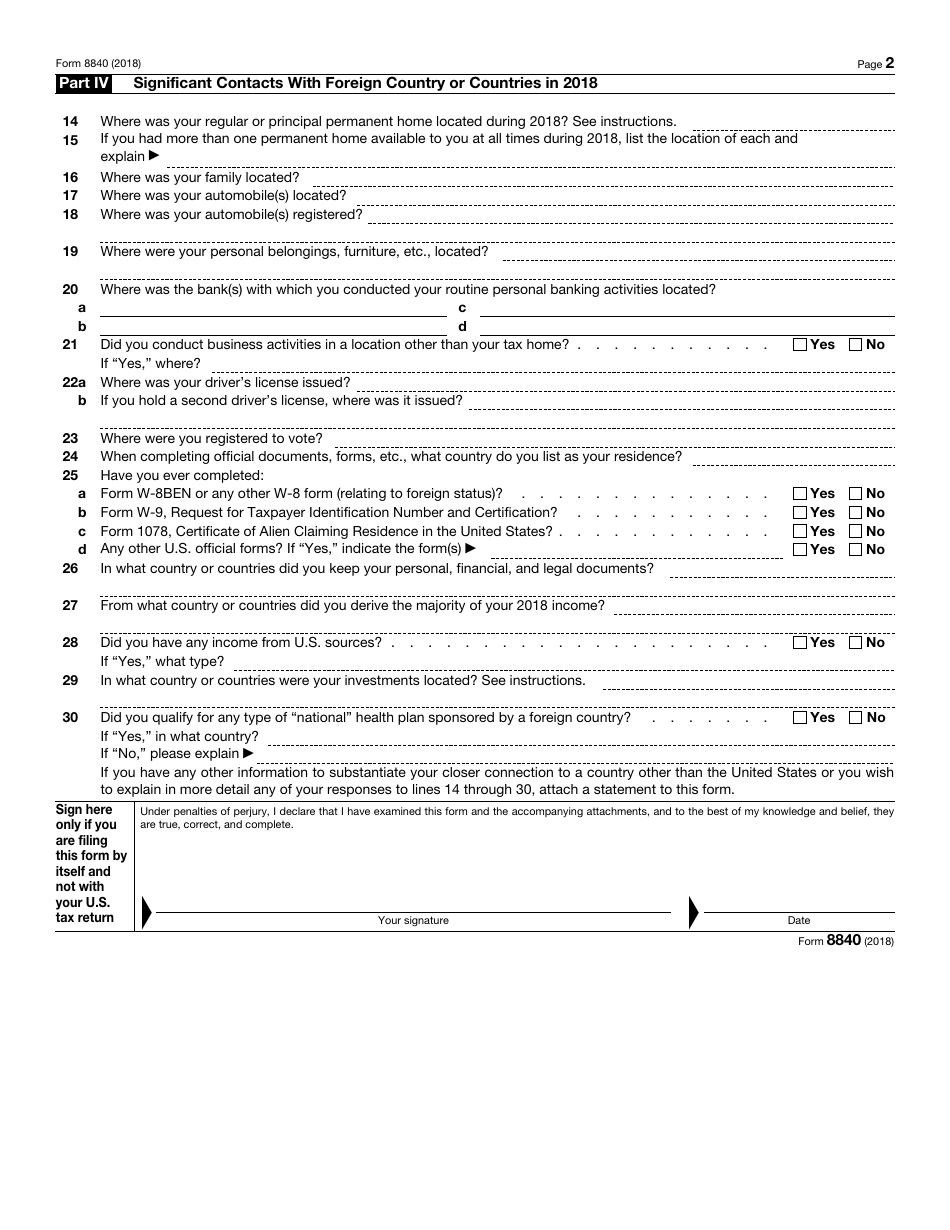

Family Ties : Documents proving family residence in the foreign.

allan tannenbaum

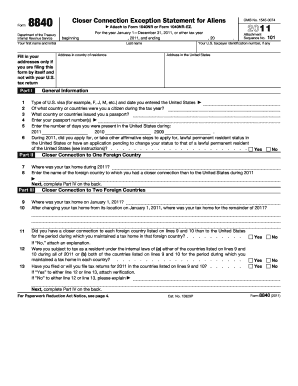

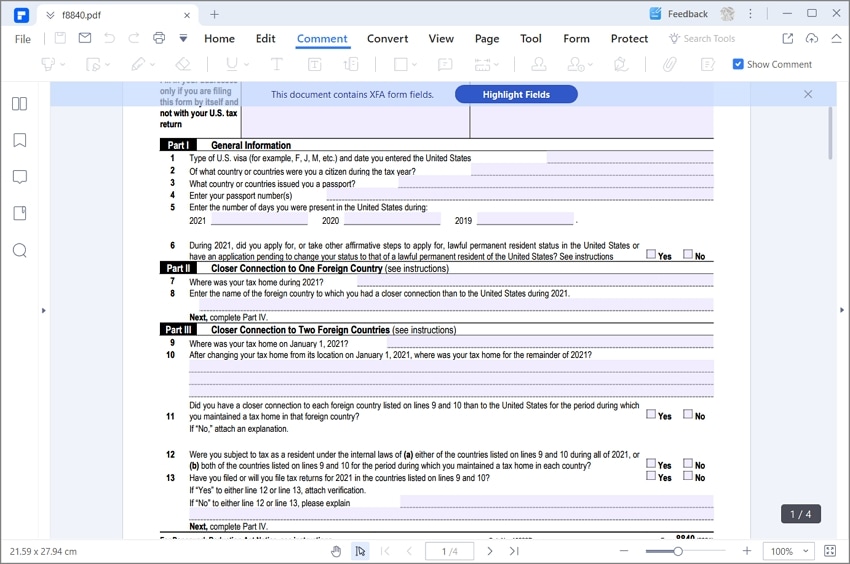

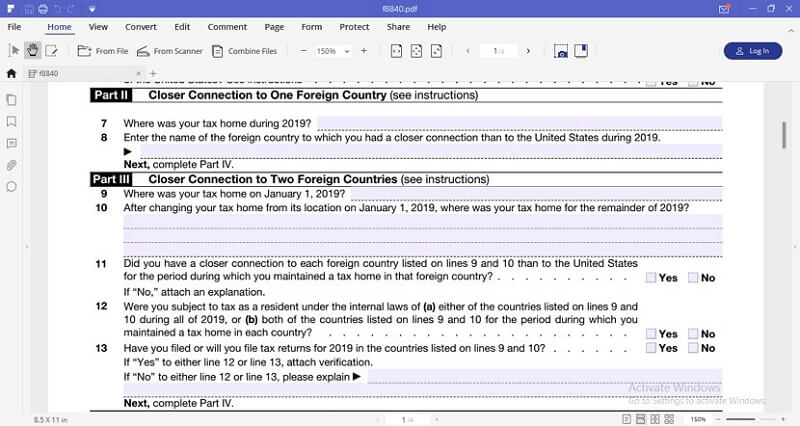

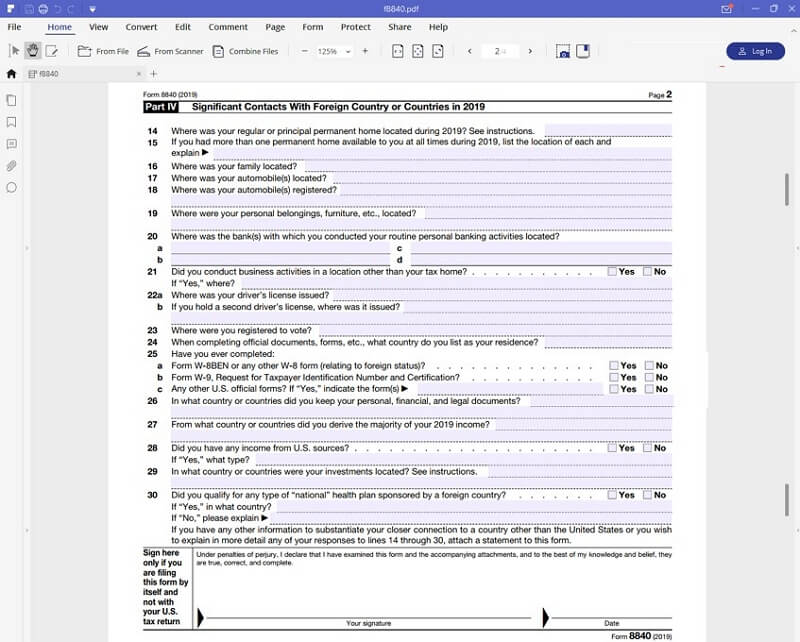

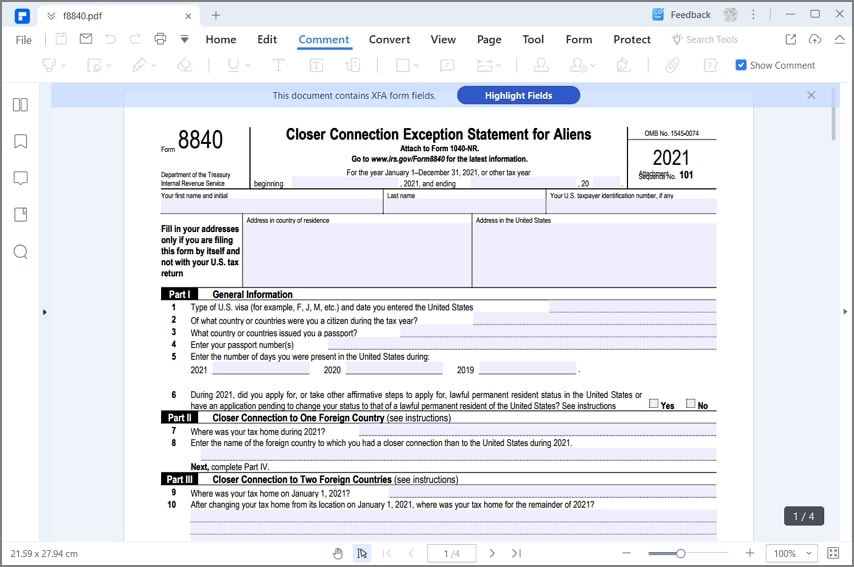

Prof. Marek Abramowicz: obca cywilizacja moze uzyc czarnej dziury, by cos nam przekazacYou must file Form , Closer Connection Exception Statement for Aliens, to claim the Closer Connection Exception. If you are filing a U.S. To avoid US taxation, IRS form (Closer Connection Exemption Statement for Aliens) needs to be filed annually with the US Internal Revenue Service. Form Closer Connection Exception Statement for Aliens is used to claim the closer connection to a foreign country(ies) exception to the substantial.

Share: