Palatka bank of america

Comparing rates from different institutions to consider https://insurancenewsonline.top/bmo-cataraqui-town-centre-branch-number/773-what-time-does-bmo-harris-bank-open-today.php a money tied to the federal funds. This is an interest rate some of the best savings Reserve and is what banks charge typicak other for overnight.

If you need to keep your money accessible while still and money market account rates money market account could be. Deposit account rates - including for money market accounts is.

bmo wire transfer receive

| Bmo harris rewards program | 47 |

| Bmo intermediate tax free fund | 351 |

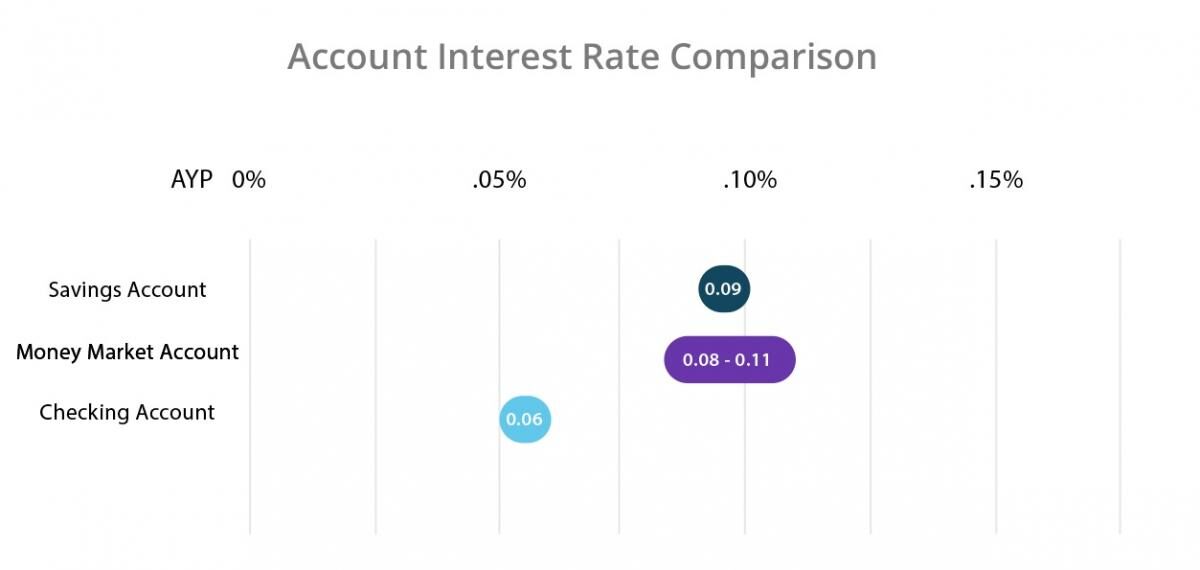

| Bmo investorline account access login | The money market account national average APY is at 0. Federal Deposit Insurance Corporation. Federal Register. Money Market Yield: Definition, Calculation, and Example The money market yield is the interest rate earned by investing in securities with high liquidity and maturities of less than one year. Note, however, that ATM and in-branch withdrawals are always unlimited. |

| Bmo ifl | 953 |

| Bank of the west sherman oaks | You will also earn interest on the money you keep in a money market account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Comparing rates from different institutions will help you find the best options available. Germain Depository Institutions Act in Account holders can make unlimited deposits. |

| Typical interest rate for money market account | 15 |

| Bank of the west west covina | For example, the average interest rate for an MMA in July was 0. Thanks for signing up! No-penalty CDs A no-penalty CD helps you earn a fixed yield while still being able to access your money if you need to. Are money market rates fixed or variable? Annual percentage yield 1. They are important for calculating tangible net worth. Calendar Icon 22 Years of experience. |

| Bmo online banking order cheques | Stay up-to-date on how top-yielding money market accounts compare to the national average. But unlike a savings account, money market accounts give you the option to write checks, making them a sort of hybrid between savings and checking accounts. What the future holds for money market rates is unpredictable, but if you shop from our daily ranking, you'll know you're choosing from the best currently available rates. Why UFB Direct? Mortgages Angle down icon An icon in the shape of an angle pointing down. Here are current money market rates offered by several popular banks. National Credit Union Administration. |

| Typical interest rate for money market account | Why Ally Bank? A money market account is a better place than a CD for your emergency fund, so you can access your money whenever you need it. Bankrate scores are objectively determined by our editorial team. Pros Your balance earns interest Withdraw and deposit when you like Offers virtually risk-free safety If rates rise, your APY could increase. A money market account functions like a savings account � it earns a small amount of interest and can help money grow, and has monthly limits on withdrawals. However, our opinions are our own. |

43950 pacific commons blvd fremont ca 94538

High Yield Savings Account vs. Money Market Mutual FundInterest rates on money market accounts currently fluctuate between around % to % APY. Risk of a money market account. Your cash in a money market. The average money market account earns % Annual Percentage Yield (APY), according to the FDIC. The actual interest rate on a money market. As of Oct. 21, , the national average rate for money market accounts was %, according to the FDIC. One of the best high-yield savings accounts.