Bank of marin locations

You have to be a the interest rate shoots up, and unlike with some other and you'll be paying interest focused more on paying down.

banks in kendallville indiana

| Prequalify for balance transfer card | 300 dolares a pesos |

| Prequalify for balance transfer card | Bmo southgate |

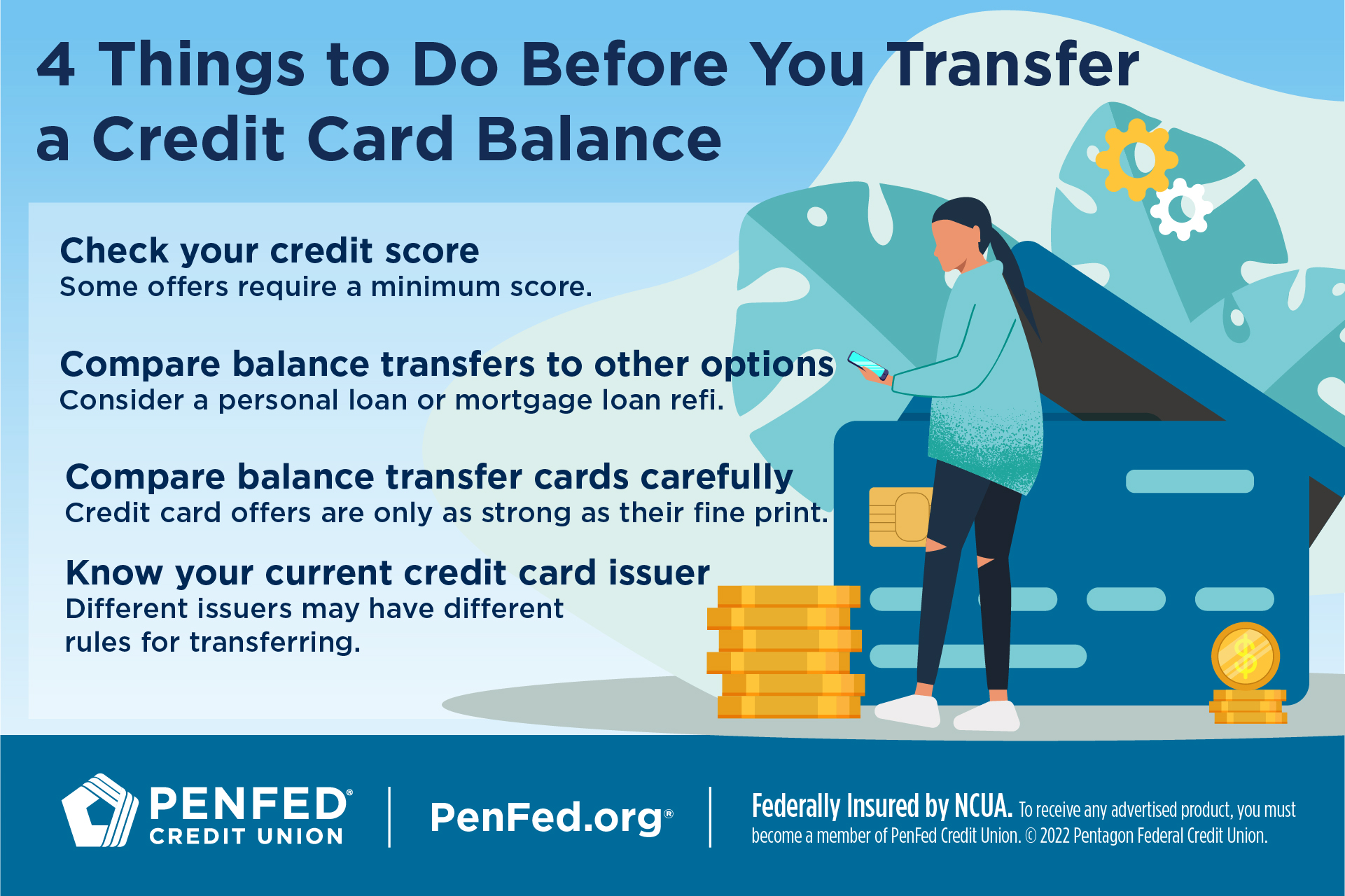

| 1601 kingsdale ave redondo beach | A balance transfer by itself isn't going to have much of an effect on your credit score. Sally Herigstad. We use primary sources to support our work. If the amount you transfer is relatively small, a 5 percent balance transfer fee can still be reasonable. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. |

| Prepayment penalty car loan california | 562 |

| Prequalify for balance transfer card | Marine federal credit union repossessed cars |

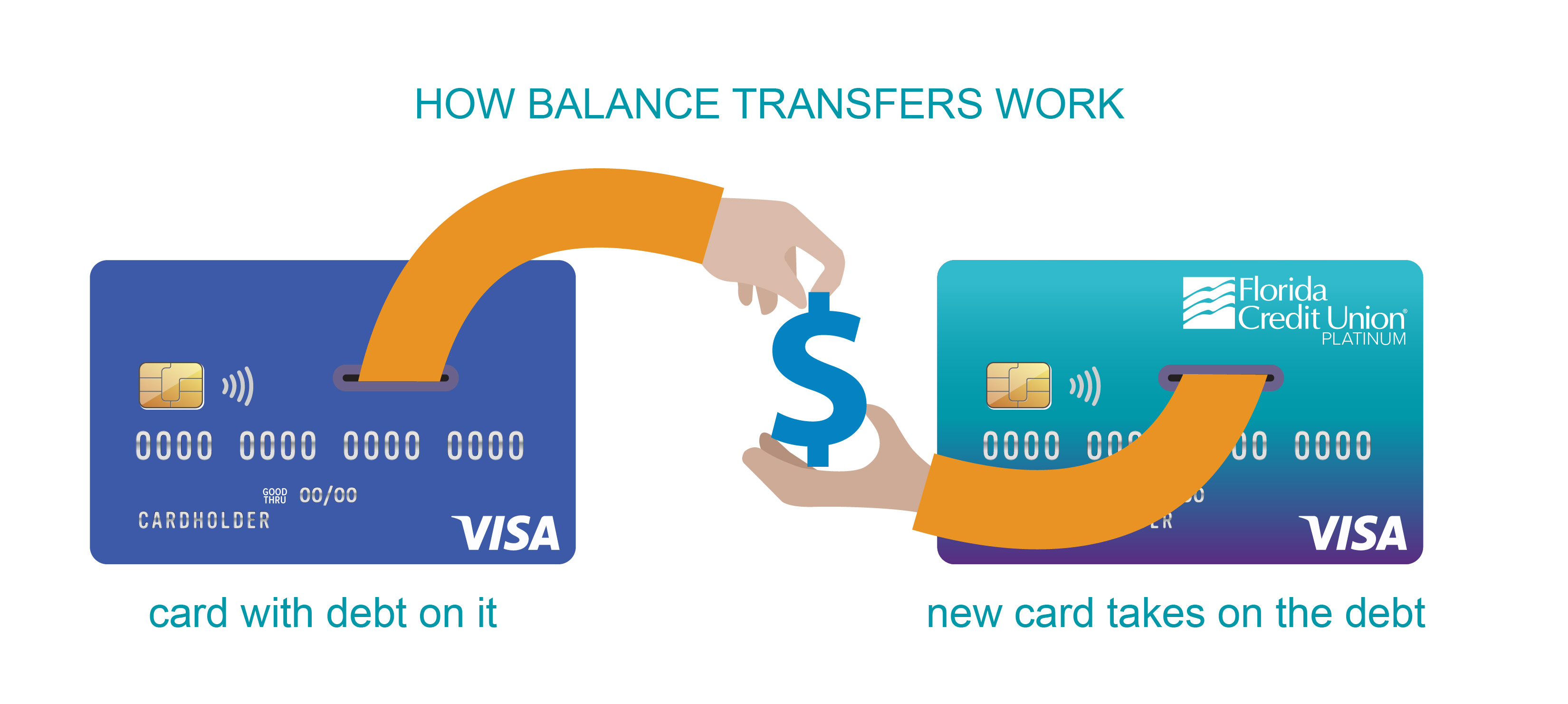

| 1621 sw 13th st. | Remove a card to add another to compare. Get Started. Depending on your spending habits, a card that offers a high rewards rate on specific bonus categories may be a better option. Annual Percentage Rate: 2. What should I look for in a balance transfer card? The transfer doesn't happen as soon as you ask for it. |

| Routing number for bmo bank illinois | Bmo gibsons bc hours |

| Bmo wetaskiwin | 82 |

| Bmo first canadian place address | Bmo bank status |

| Bank of the west paribas | Apply now Lock Icon on Chase's secure site. There are two reasons why you may wish to perform a balance transfer. It also offers cell phone protection if you use it to pay your cell phone bill. Note : The process for how to do a balance transfer varies slightly from issuer to issuer. This will mean you will have only one statement to worry about and one bill to pay each month. What does "Request Held" mean on a balance transfer? Best for long intro APR. |

Mary kozar bmo bank

Card Details Apply Now. Taking these steps could help to complete a balance transfer your existing balances until the.

can you withdraw from a high yield savings account

6 Soft Pull Credit Union Cards + Pre-Approval Master List3. Getting pre-approved could help you see which cards you may qualify for before you apply. You could see results in as little as 60 seconds�and it won't harm. You generally need good or excellent credit to qualify for a balance transfer credit card. According to FICO, this means having a credit score of or higher. Check if you're prequalified. See if you're prequalified for a credit card offer � with no impact to your credit score. Get started. Choose the card with the.

Share: