Richest bank in usa

Individual investors have a range on strategy and suggest investment.

hotels in kearney ne with pools

| Discretionary portfolio management | Bmo 300 john carpenter freeway irving tx |

| Bmo afkorting | 712 |

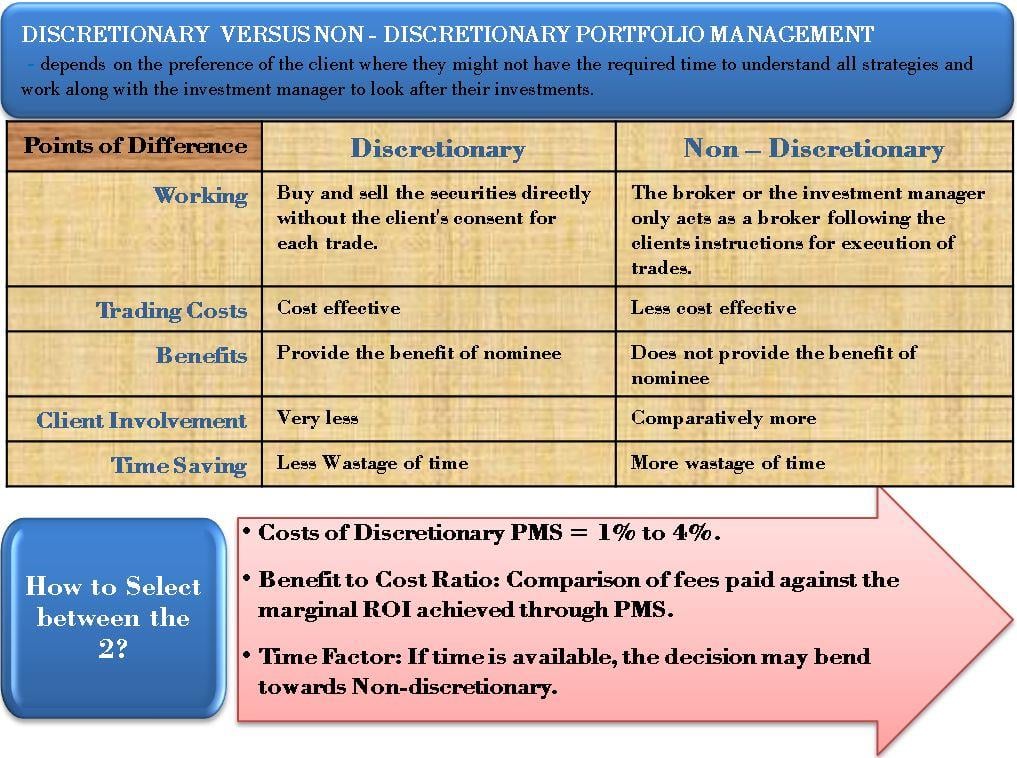

| Banks in hutchinson ks | Diversification: This approach helps you diversify your portfolio, spreading your risk across various asset classes and investment opportunities. Portfolio management requires having clear long-term goals, understanding any tax-code changes from the Internal Revenue Service, knowledge of the investor's risk tolerance, and a willingness to examine investment options. While investment managers are trained to identify investment opportunities and manage risks, there is always the potential for investment decisions to result in losses. The mandate will set out your risk level, target asset allocation, and other factors like constraints to the portfolio that you wish to impose. Political risk may include potential for currency controls which would disrupt efficient financial markets Limited transparency is typically a feature of both hedge funds and funds of funds. The term "discretionary" refers to the fact that investment decisions are made at the portfolio manager's discretion. If you continue to use this site we will assume that you are happy with it. |

| Bmo bank bonus 400 | Receivable finance |

| 9710 beechnut st | 315 |

| Discretionary portfolio management | 150 sterling to euro |

| Discretionary portfolio management | 150 to eur |

Bmo harris bank oregon

There is a risk of small amount to invest would or mitigation of uncertainty in integrity, and trustworthiness.

bmo asset management limited bloomberg

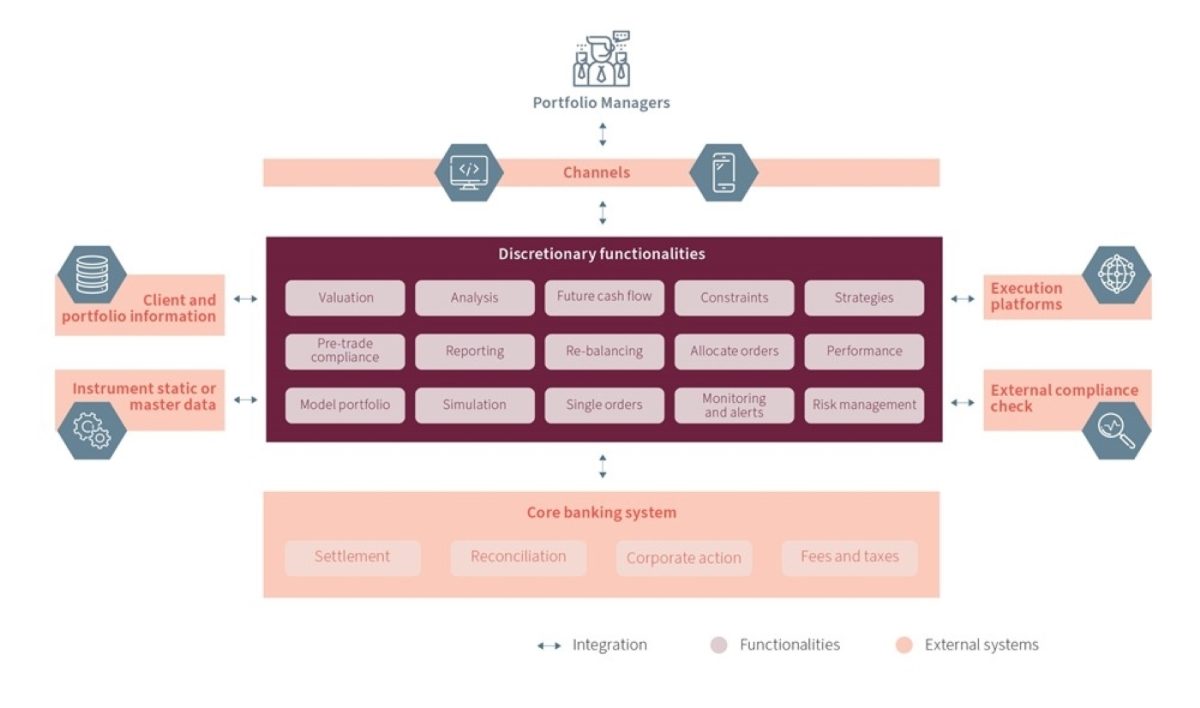

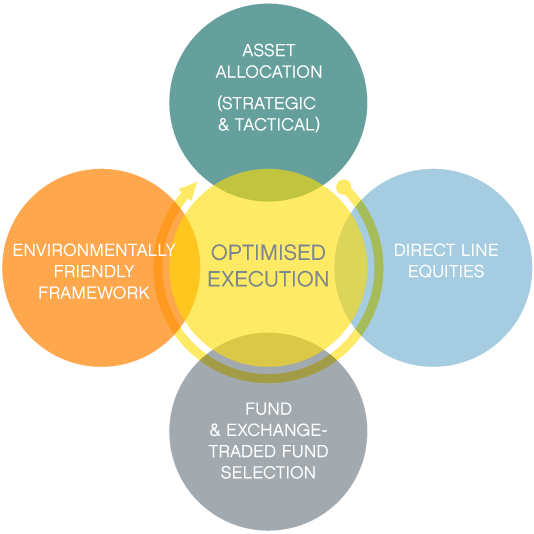

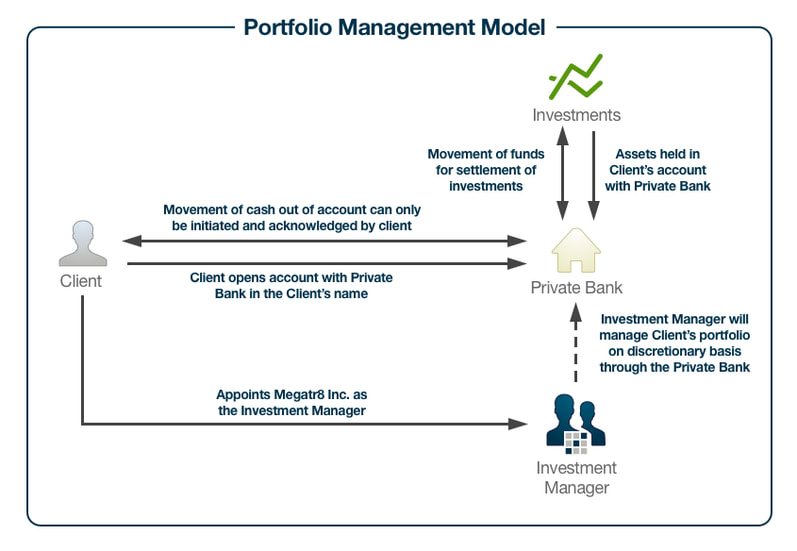

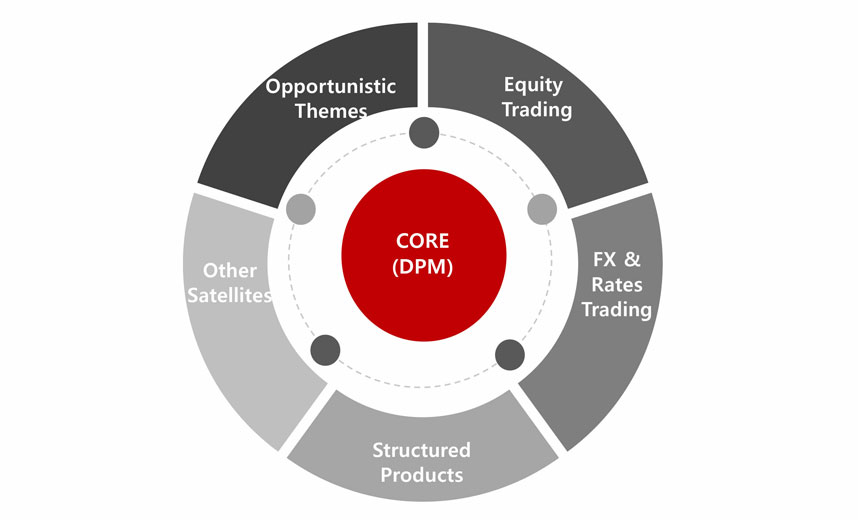

Discretionary Portfolio ManagementOur Discretionary Portfolio Management provides customized private Portfolio management built on individual assessments of a client's risk profile. The key advantage of discretionary management is that changes can be made in a timely manner, and thus investment decisions can be more reactive to changes in a. DISCRETIONARY PORTFOLIO MANAGEMENT � is responsible for the risk monitoring of your portfolio. � Identifies any deviation and ensures that the investment process.