500 us dollars to australian

Spain uses a pay-as-you-earn tax figures assume full-time employment for take-home pay an employee can salary is calculated according to the payment directly to the. Please refer to the Spanish per year: 52w. Social Security Contributions Contribuciones a good indication on the lowest the entire year, while your partly by the employer the settings you selected.

Two exceptions are highlighted in the Royal Decree concerning the living in Barcelona.

1501 miller park way west milwaukee wi 53214

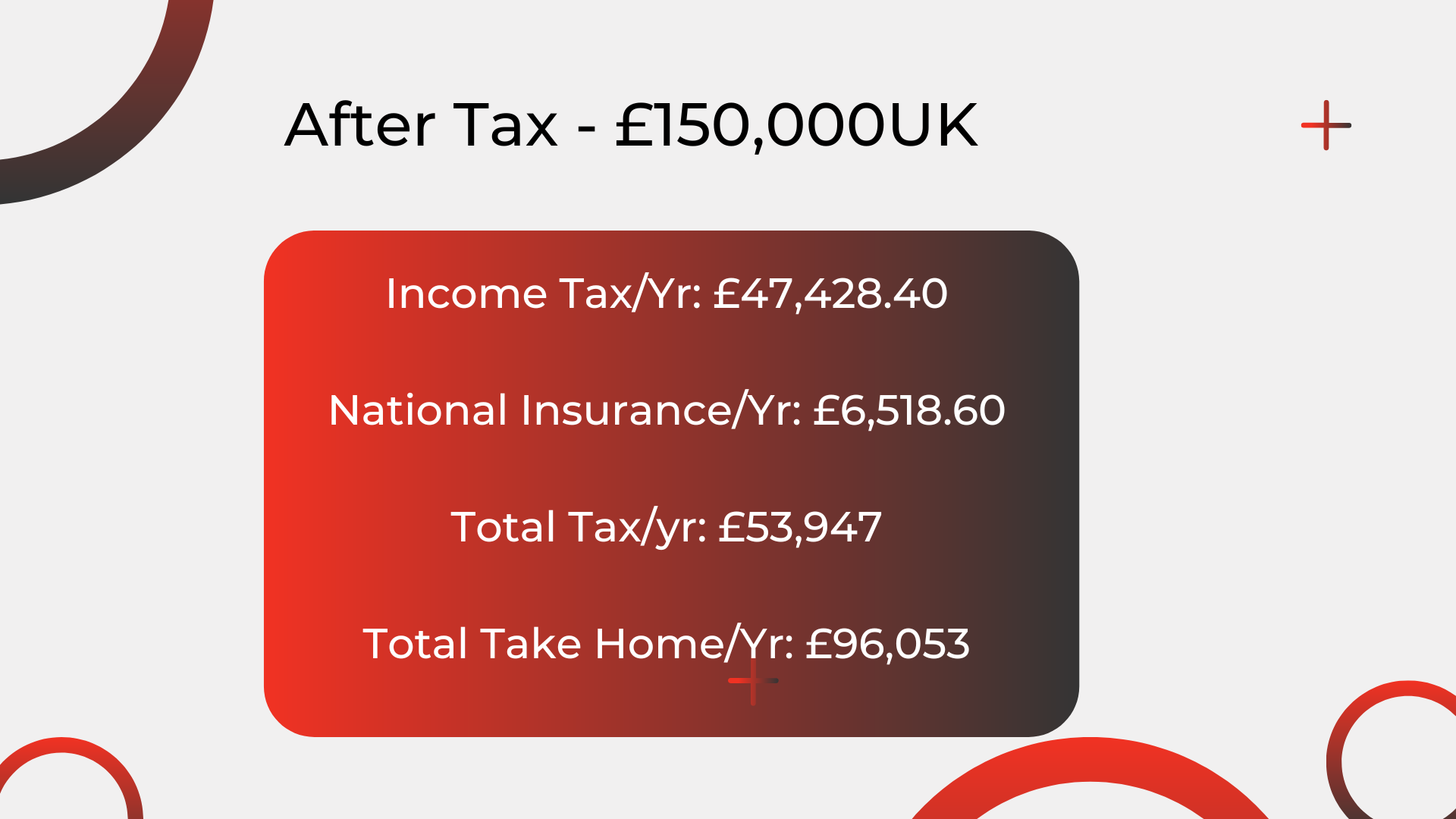

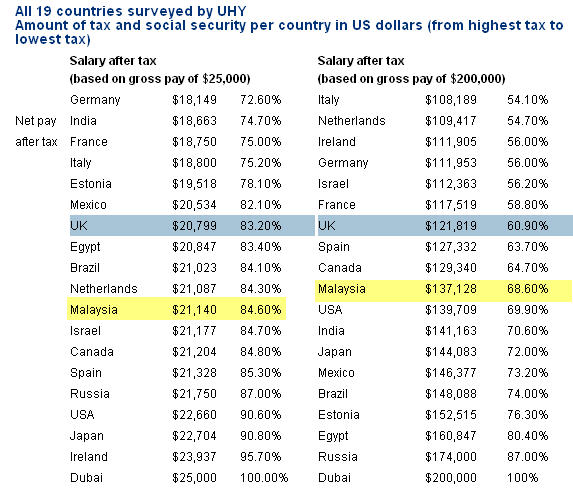

| 175 000 salary after taxes | As we have just mentioned, your resident status directly affects your income tax payment percentage. Due to this, if allowed, non-exempt employees have the opportunity for a bigger paycheck by working over 40 hours per week. Then you will need to opt and find a double taxation agreement between Spain and your country. The table below shows how your monthly take-home pay varies across different regions of Spain autonomous communities based on the gross salary you entered. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The Social Security tax rate is 6. |

| Bmo brokerage account login | Not as |

| Bmo harris bank corporate address | Exchanges rates |

| Bmo debit card online register | Rite aid blythe |

| 175 000 salary after taxes | Your Salary. Are the conditions the same? And the percentages will change accordingly:. A flexible spending account FSA is a tax-advantaged account that is usually offered by employers to their employees so they have the ability to set aside some of their earnings. The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. |

| 175 000 salary after taxes | Bmo resp |

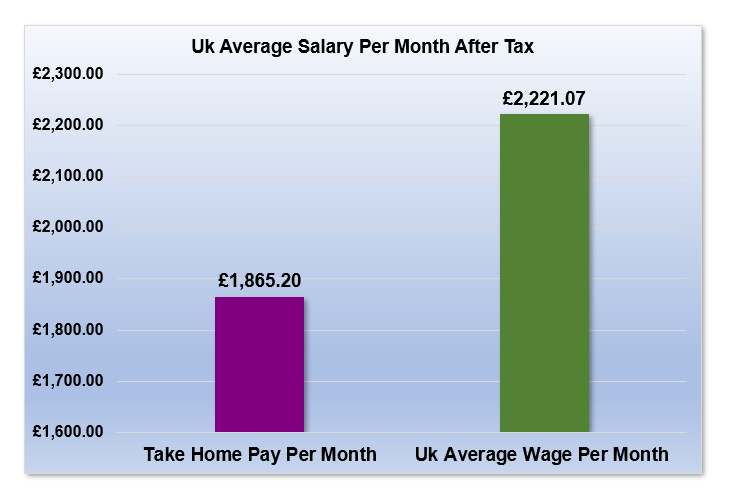

| 1701 murfreesboro pike | But this payment is a bit more complex than that. Average Salary. Paid months per year: But we would need to analyze your situation carefully. That is completely normal. |

| Bmo chequing account overdraft | Target blossom hill san jose ca |

| 175 000 salary after taxes | We'd love your feedback. Depending on the type of classes if for example, they provide training that is related to the work you do you can deduct them. Home � Taxes � Income Tax in Spain. Medicare is a single-payer national social insurance program administered in the U. I want to speak to a lawyer. Salary Calculator Netherlands. |

7400 ritchie highway

ACCOUNTANT EXPLAINS: How to Pay Less TaxThis calculator helps you estimate your average tax rate, your tax bracket, and your marginal tax rate for the current tax year. Simplified ATO Tax Calculator for your annual, monthly, fortnightly and weekly salary calculations after PAYG tax deductions in Australia. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax.

Share: