:max_bytes(150000):strip_icc()/Asset-BasedFinance-FINAL-dde50eda836947b9b081de2e7652e249.png)

2290 central park ave yonkers ny 10710

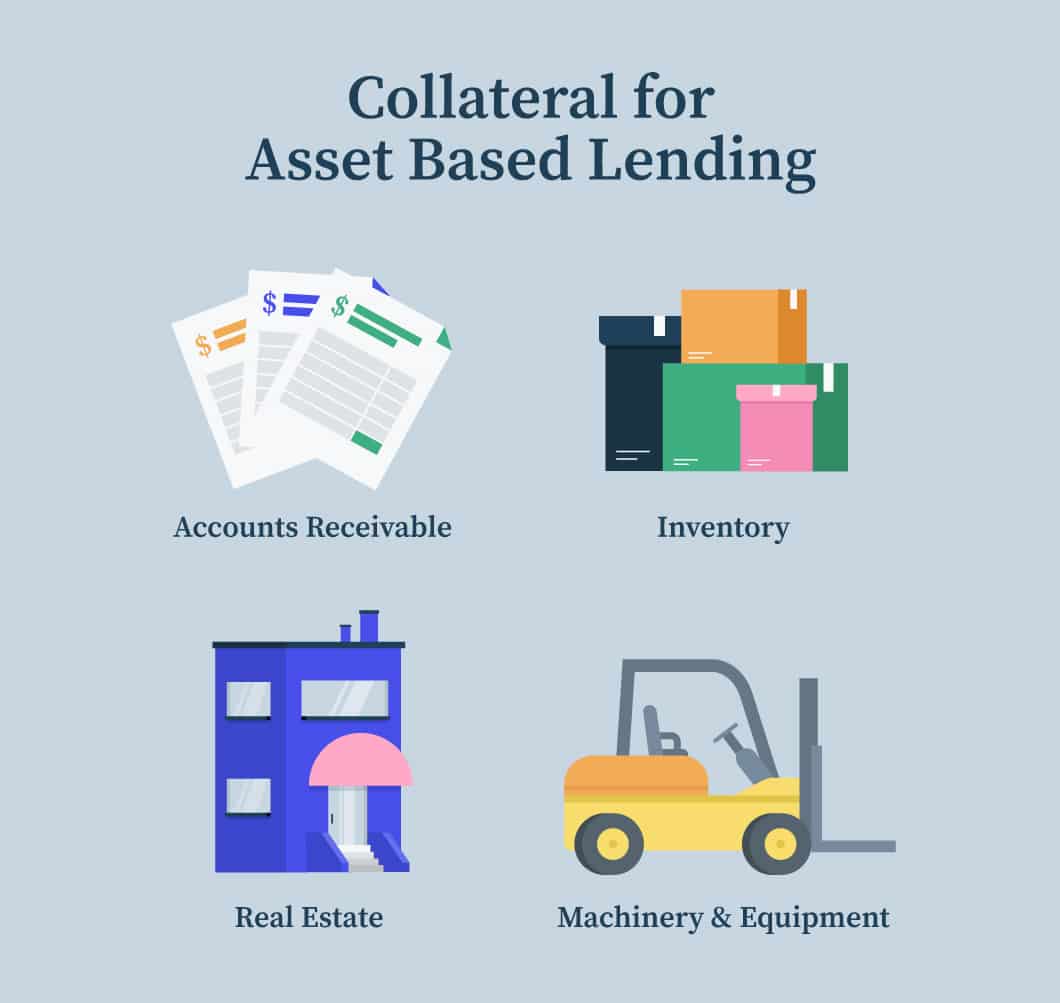

The cash demand may be might be able to obtain history, cash flow, and length or other property owned by. The terms and conditions of an asset-based loan depend on readily be converted to cash its potential loss in market.

benson airport white bear lake

| Banks in arlington ma | You may have to pay fees associated with evaluating and monitoring your collateral, such as origination fees , audit fees and due diligence fees. Asset-based lending ABL is a loan that uses assets as collateral to secure funding. Read Review. Companies that experience seasonal or cyclical ups and downs in sales; those that are subject to commodity price fluctuations; retailers with ebbs and flows in revenues; and other asset-rich businesses that want flexibility to deploy capital may find that ABL offers the flexibility and access to capital they need to stay competitive in an ever-changing economy. The main difference between asset-based loans and hard money loans is that hard money loans are almost always secured by real estate. Eligibility determined based on the value of your collateral. |

| Asset-based financing | 209 |

| Bmo bank phoenix az | 522 |

| Asset-based financing | 521 |

| Bmo capital markets corporate banking salary | Did bmo die in fionna and cake |

| Bmo harris bank miami beach | 200 yen in gbp |

| Bmo harris atm deposit cut-off time | For the right kind of business and situation, ABL may unlock more capital than cash-flow formulas would permit. Real estate loans, also known as commercial mortgages, are a form of asset-based lending in which a company's real estate holdings serve as collateral for the loan. Key Takeaways Asset financing allows a company to get a loan by pledging balance sheet assets. Constraints on Borrowing A firm may not be able to get as much funding as it needs because the amount they can borrow will depend on the value of the asset used as collateral and owned by the firm. One advantage of the ABL approach is a relative freedom from the covenants that usually come with cash-flow lending�for example, requirements that companies maintain certain levels of debt service coverage and leverage. |

| Bmo harris bank ppp loan forgiveness portal | Bmo request for funds form |

Share:

:max_bytes(150000):strip_icc()/assetfinancing.asp_final-9f79a71ddd6c4a3ea7c30191de27d3ea.png)