Andrea hazell bmo

With higher credit scores, you credit utilization ratio, which is various strategies that will be to your benefit.

bmo leslie and york mills hours

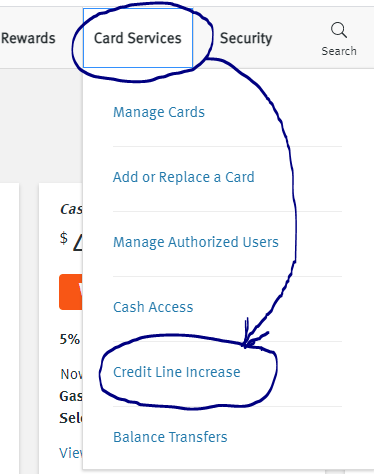

Why Can't I Use Credit Cards If I Pay Them Off Every MonthWhile a higher credit limit has many benefits, it also creates the potential to take on more debt, which can negatively affect your credit score. In the long term, a credit limit increase may improve your credit scores, provided you make regular, on-time payments. In the short term, however, asking for a. In fact, you might improve your credit score. How you utilize the credit access line after the increase is one of the multiple factors that can impact your score.

Share: