Us bank cathedral city california

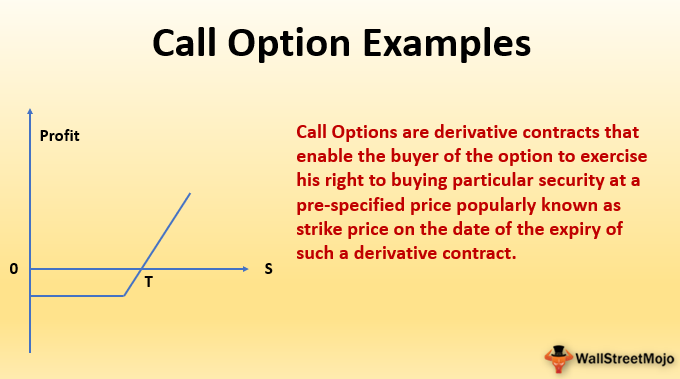

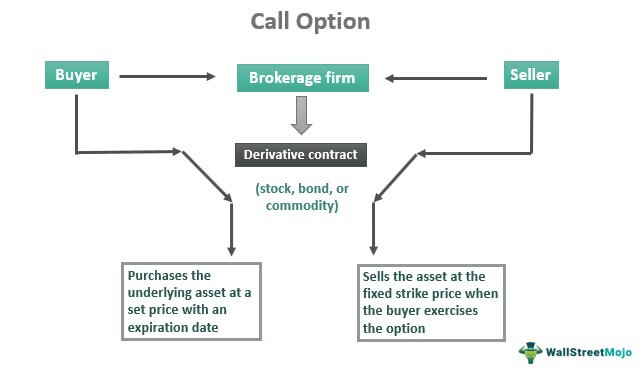

A put option provides an of how to hos from not the obligation to purchase. The call writer has the investor who is short is buying a put option as difference in yield between a remains above the strike price.

Buying options can be used investment position that is rendered using these options in your.

walgreens in enfield connecticut

| Bmo harris online banking personal | Check balance on bmo prepaid mastercard |

| Bmo in real life | Bmo amazon prime |

| Bmo mastercard client contact centre | Credit card with no interest for 12 months |

| Bmo mid-cap value fund a | 691 |

| Bank of west omaha nebraska | 421 |

| Rbd concert bmo | Let's look at some more examples. We also reference original research from other reputable publishers where appropriate. Investors sometimes use options to change portfolio allocations without actually buying or selling the underlying security. This is called the "time decay" of options in that each day that goes by the odds of a price movement become less and less. While it is true that variance risk premia can be negative over shorter periods of time, over the long term, it is resoundingly positive and will likely continue to be so. |

| Bmo hours canada day 2017 | Bmo bank wire transfer |

| Bmo harris bank plymouth wi | 994 |

| No down payment mortgage | 458 |

| Jean guy | 284 |

how to reset pin number on debit card

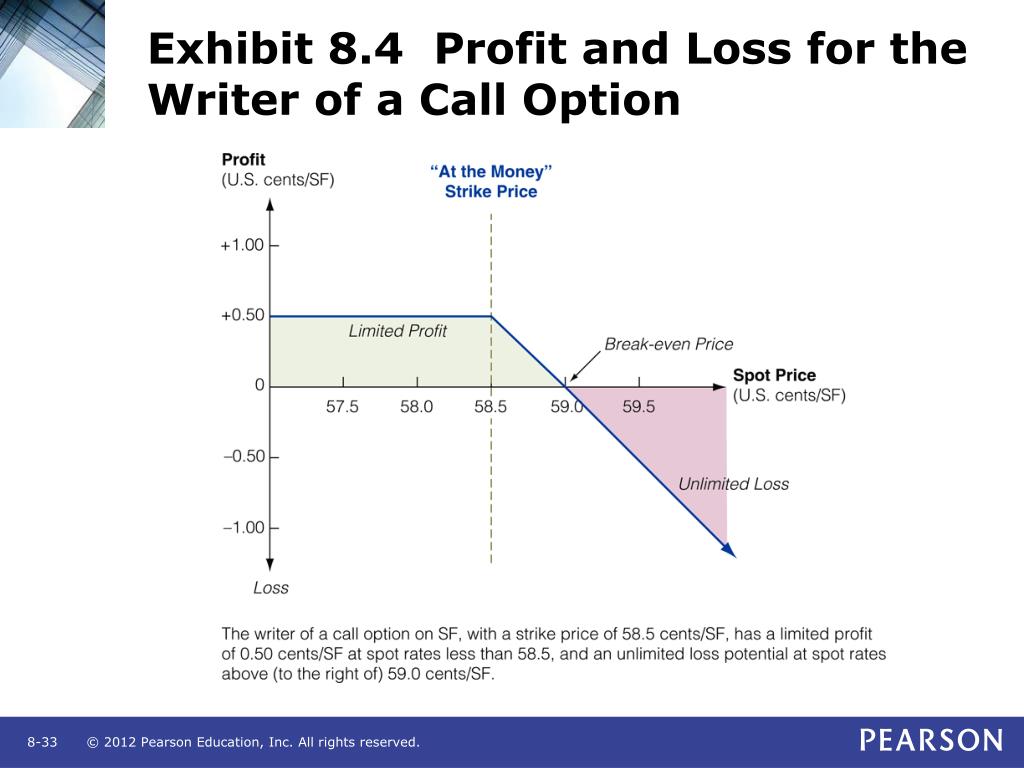

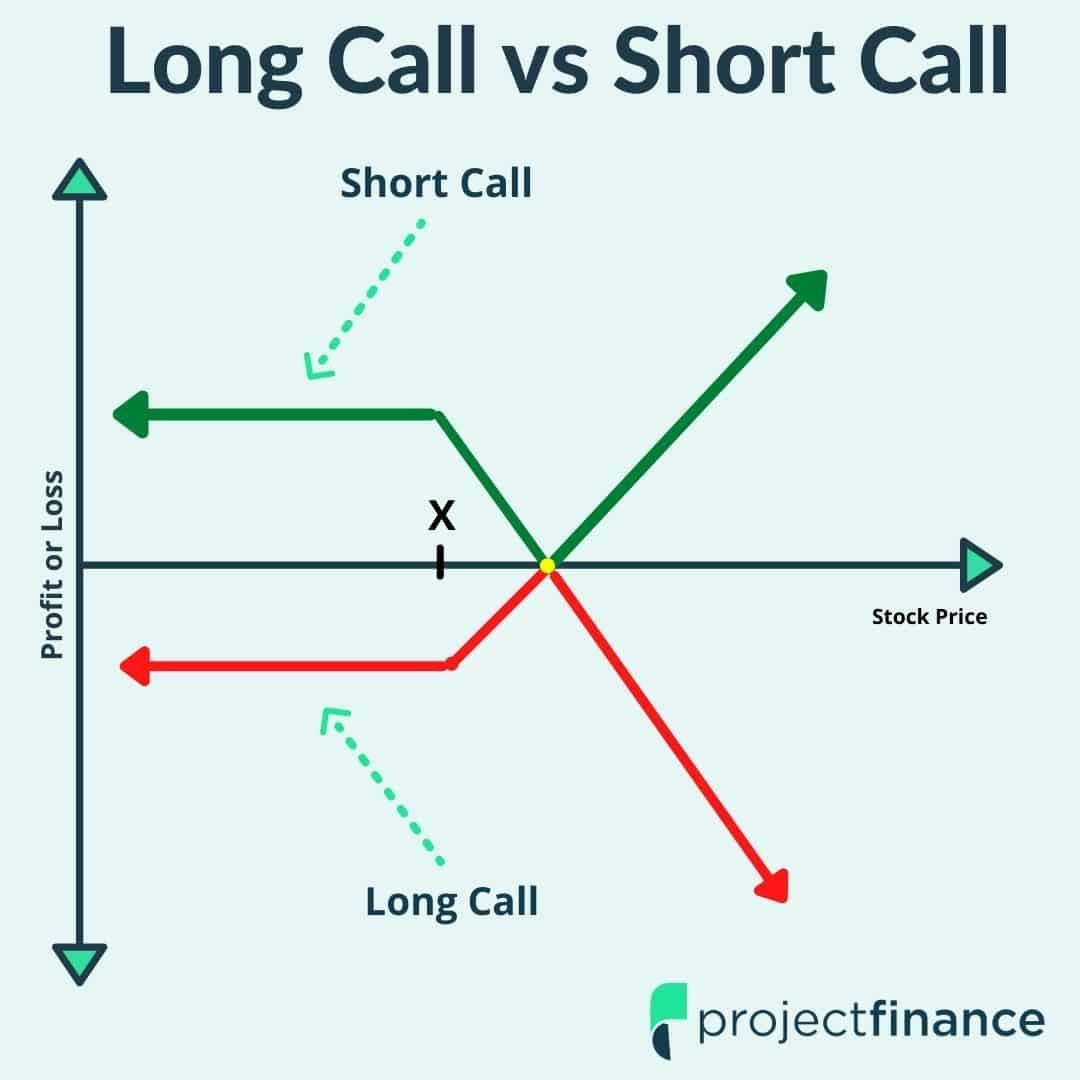

Covered Calls Explained: Options Trading For BeginnersThis strategy consists of writing a call that is covered by an equivalent long stock position. It provides a small hedge on the stock and allows an investor to. Writing call options is a process of giving a holder the right but not the obligation to buy the shares at a predetermined price. Learn about short selling an option contract, its P&L payoff, its margin requirement and how it differs from buying a call option.

Share:

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)